Browse by Vehicle / Can-Am On-Road Financing and Loans

Can-Am On-Road Financing & Loans

Roadrunner Financial knows Can-Am On-Road financing. Explore models, compare instant loan offers, and secure your ride at a local dealership.

No commitment. No impact on credit score.

Compare Options with Roadrunner Financial®

We welcome prime and subprime buyers to check if they pre-qualify for financing. You can instantly compare offers online without any impact to your credit, no strings attached.

New & Used

Can-Am On-Road Models

Ryker

Ryker Rally Edition

Spyder F3

Spyder F3-S

Spyder F3-S Special Series

Spyder F3-T

Spyder F3 Limited

Spyder RT

Spyder RT Sea-to-Sky

Spyder RT Limited

Here’s How it Works

GET PREQUALIFIED

Complete a quick application and get an instant prequalified credit decision. No commitments. No impact on credit score.

REVIEW RATES & TERMS

You’ll see real terms and monthly payments. Compare your personalized financing offer and choose what’s right for you!

SECURE YOUR NEW RIDE

Take your prequalified credit offer to a local dealership, test-drive the vehicle, complete and sign your paperwork electronically, and they’ll hand over the keys!

No commitment. No impact on credit score.

Can-Am On-Road Loan calculator

Calculate your Can-Am On-Road

Loan Payment

Use our Can-Am On-Road Loan Calculator to see how a monthly payment fits into your budget. Play around with loan terms, estimate the cost of your Can-Am On-Road financing, and apply to Roadrunner Financial with no impact on your credit score. To estimate your monthly loan payments, select:

Let's Break it Down

Loan Amount

Interest Rate

Loan Term

Get Prequalified

Can-Am On-Road Loan Questions? Here to help!

What’s the best Can-Am On-Road loan term?

Loan term affects both your interest rate and monthly payment – when the term is longer, monthly payment is lower. Plus, certain terms will have certain rates available. The best Can-Am On-Road loan term is the one with the right balance of time, rate, and budget for you! Our most commonly used loan terms are between 36 – 72 months.

What’s the minimum credit score to finance a Can-Am On-Road?

How are Can-Am On-Road loan interest rates calculated?

I want to get prequalified, does applying hurt my credit?

Nope! We’re able to pre-qualify you for financing without any credit impact. We’re one of the only Can-Am On-Road lenders with soft credit pulls. That means our application will initiate what’s called a “soft inquiry” on your credit, which does not impact your credit score. The only time we’ll do a hard inquiry is when you are ready to sign your contract.

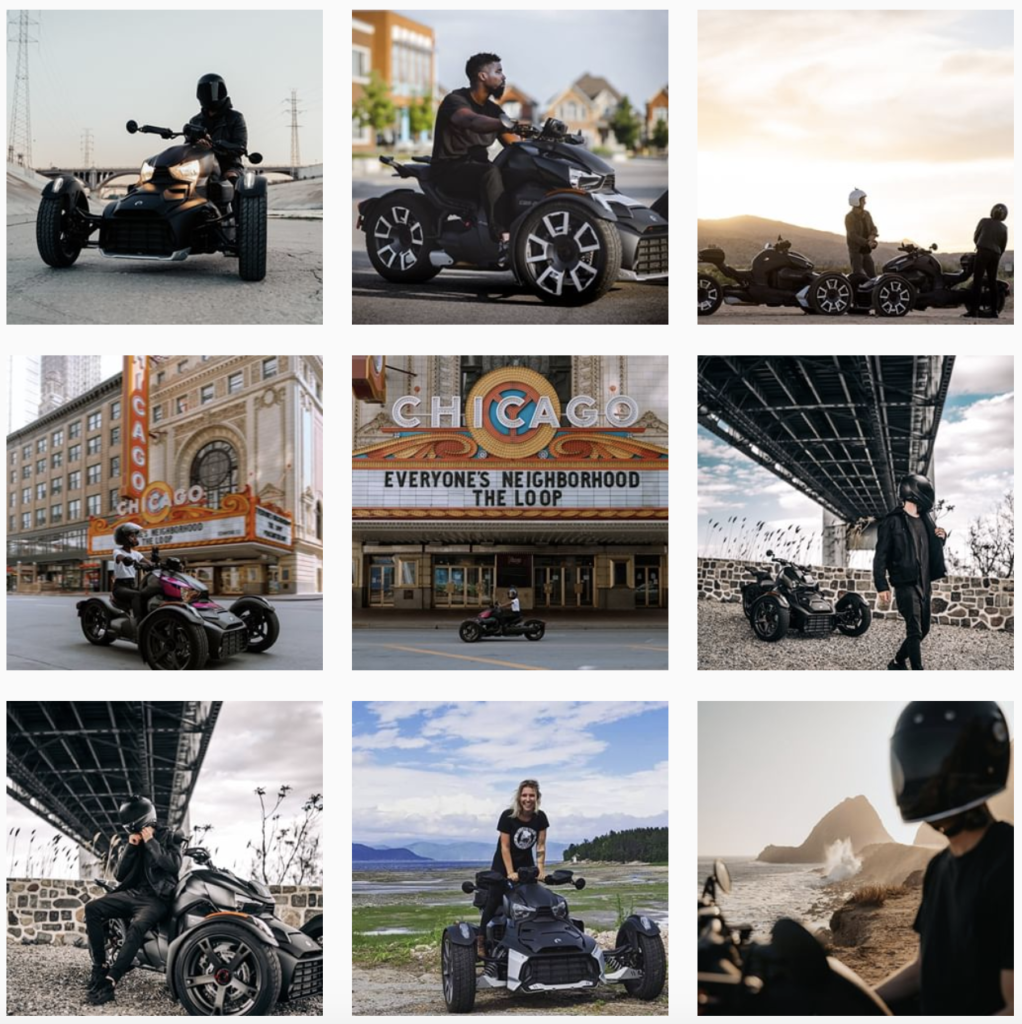

Join the Can-Am On-Road Life & Pay Later

About BRP

Get Riding with

Roadrunner Financial

Compare personalized credit offers and secure your vehicle at a local dealership.

No commitments. No impact on credit score.

- 23 Powersports Financing

- American Landmaster

- Aprilia Financing

- ARGO Financing

- Ariens Financing

- Arctic Cat Financing

- Bad Boy Mowers Financing

- Benelli Financing

- Bennche Financing

- BigDog Mower Financing

- Bighorn Financing

- Bintelli Financing

- BMS Motorsports Financing

- BMW Financing

- Can-Am Off-Road Financing

- Can-Am On-Road Financing

- CFMOTO Financing

- Club Car Financing

- Country Clipper Financing

- Denali Financing

- Doohan Financing

- Ducati Financing

- E-Z-GO Financing

- Exmark Financing

- Ferris Financing

- Genuine Scooters

- Goggo Financing

- Grasshopper Financing

- Greenger Financing

- Hisun Financing

- Honda Financing

- Husqvarna Motorcycles Financing

- Hustler Financing

- Indian Motorcycle Financing

- Intimidator Financing

- Jacobsen Financing

- Kawasaki Financing

- KTM Financing

- Kymco Financing

- Lance Financing

- Mahindra Financing

- Massimo Financing

- Moto Guzzi Financing

- Odes Financing

- Piaggio Financing

- Polaris Financing

- Polaris Slingshot Financing

- Qipai Financing

- Sea-doo Financing

- Sea-doo Switch Financing

- Segway Powersports Financing

- Simplicity Financing

- Ski-Doo Financing

- Snapper Financing

- Snapper Pro Financing

- Spartan Mower Financing

- SSR Motorsports Financing

- Suzuki Financing

- Sunright Financing

- SYM Financing

- Textron Off-Road Financing

- Toro Financing

- TrailMaster Financing

- Triumph Financing

- UBCO Financing

- Ural Motorcycle Financing

- Vespa Financing

- Volcon Financing

- Yamaha Financing